Are you looking for car insurance in Peoria, Illinois? Navigating the realm of auto coverage can be daunting, but fear not! In Peoria, securing proper car insurance is paramount for safeguarding your vehicle and financial well-being. With many options available, finding the right policy tailored to your needs and budget is essential. From liability coverage to comprehensive plans, Peoria offers diverse insurance solutions to suit every driver. Understanding the local driving landscape and potential risks can help you make informed decisions about your coverage. Let’s explore the world of car insurance Peoria and find the perfect policy for you!

Types of car insurance offered in various states of the USA

Car insurance offerings vary across states in the United States due to differing regulations and requirements.

Liability coverage

Common types of car insurance include liability coverage. This is mandatory in most states and covers damages and injuries to others in an accident you cause.

Personal Injury Protection (PIP)/Medical Payments coverage

Some states also require Personal Injury Protection (PIP) or Medical Payments coverage, which pays for medical expenses regardless of fault.

Collision coverage

Collision coverage helps repair or replace your car if it’s damaged in a collision, regardless of fault.

Comprehensive coverage

Comprehensive coverage protects against non-collision incidents like theft, vandalism, or natural disasters.

Uninsured/Underinsured Motorist coverage

Uninsured/Underinsured Motorist coverage is essential in states where many drivers are uninsured or carry only minimum coverage. It covers your medical expenses if a driver with inadequate or no insurance hits you.

Additionally, some states offer optional coverage such as roadside assistance, rental reimbursement, and gap insurance. The last one covers the difference between your car’s value and the amount you owe on a loan or lease.

In states prone to extreme weather, like hurricanes or tornadoes, specialized coverage may be available for flood or wind damage.

Understanding your state’s specific insurance requirements and optional coverages is crucial for selecting adequate protection. Consulting with insurance agents or online resources can help you navigate the complexities. It will ensure you have the right coverage for your needs and location.

Types of car insurance Peoria offered in IL

In Peoria, Illinois, car insurance options cater to the diverse needs of drivers. Mandatory coverage typically includes liability insurance. This covers damages and injuries you cause to others in an accident. Given below are some car insurance Peoria types:

PIP (Personal Injury Protection)

Personal Injury Protection (PIP) is also necessary in Illinois. It provides coverage for medical expenses and lost wages for you and your passengers, regardless of fault.

Collision coverage

Collision coverage is optional but highly recommended. It helps repair or replace your vehicle in the event of a collision, regardless of fault.

Comprehensive coverage

Comprehensive coverage, another optional choice, protects against non-collision incidents such as theft, vandalism, or natural disasters.

Uninsured/Underinsured Motorist coverage

Uninsured/Underinsured Motorist coverage is advisable. It is beneficial in areas where many drivers lack adequate insurance. This coverage safeguards you if you’re in an accident with an uninsured or underinsured driver.

Additional optional coverages available in car insurance Peoria include roadside assistance, rental reimbursement, and gap insurance. Gap insurance covers the difference between your car’s value and what you owe on a loan or lease.

Peoria’s weather conditions and driving patterns may also prompt specialized coverage for floods or other weather-related damages.

Understanding Illinois’ insurance requirements and considering optional coverages based on individual circumstances are vital in ensuring adequate protection. Consulting with insurance professionals can help navigate the available options. People can tailor a policy in Peoria to fit specific needs and risks.

Tips for how to save money on car insurance Peoria

Saving money on car insurance requires strategic planning and understanding various cost-saving measures. First, consider bundling your car insurance with other policies like homeowners or renters insurance. Many insurers offer discounts for combining coverage.

- Maintaining a clean driving record is crucial. Drivers with fewer accidents and traffic violations often qualify for lower premiums.

- Opting for a higher deductible can lower your monthly premiums. However, ensure you can afford the out-of-pocket expense in case of a claim.

- Take advantage of available discounts. You can teach them safe driving habits, complete defensive driving courses, or be a student with good grades.

- Consider the type of car you drive, as safer and more affordable vehicles typically have lower insurance premiums.

- Review your coverage annually and adjust it based on changes in your circumstances. Paying off a car loan or reducing your commute distance helps.

- Explore usage-based insurance programs that track your driving habits through telematics devices or mobile apps. These potentially earn you discounts for safe driving behaviors.

- Finally, regularly shop around and compare quotes from different insurance providers. This ensures you get the best rate based on your profile and coverage needs.

You can effectively reduce your car insurance costs by implementing these strategies and staying informed about available discounts and options. At the same time, you maintain adequate coverage.

Risks of using car insurance tracking devices

Now, what are the risks of using car insurance tracking devices? Using car insurance tracking devices poses several risks that drivers should carefully consider.

- Firstly, these devices can compromise privacy by continuously monitoring driving behavior and locations.

- They transmit sensitive data to insurance companies. This raises concerns about data security and potential breaches.

- Inaccurate readings from these devices may lead to unfair premiums or policy adjustments for drivers.

- Some drivers may feel uncomfortable with constant surveillance and invasion of privacy.

- The data collected by these devices could pose threats against drivers in case of accidents or disputes.

- There is a risk of misinterpretation of the collected data or misuse to make assumptions about driving habits.

- Drivers may experience anxiety or stress knowing that their every move behind the wheel is under monitoring.

- These devices may also create a false sense of security, leading to riskier driving behaviors.

- There is a potential for technical malfunctions or errors in the functioning of these tracking devices.

- Installing such devices may lead to conflicts between drivers and insurance companies over data usage and interpretation.

- In some cases, insurance companies may use the data from these devices to deny claims or cancel policies.

- Drivers should carefully review the terms and conditions of these tracking devices before consenting.

Ultimately, the decision to use car insurance tracking devices involves weighing the benefits against these risks.

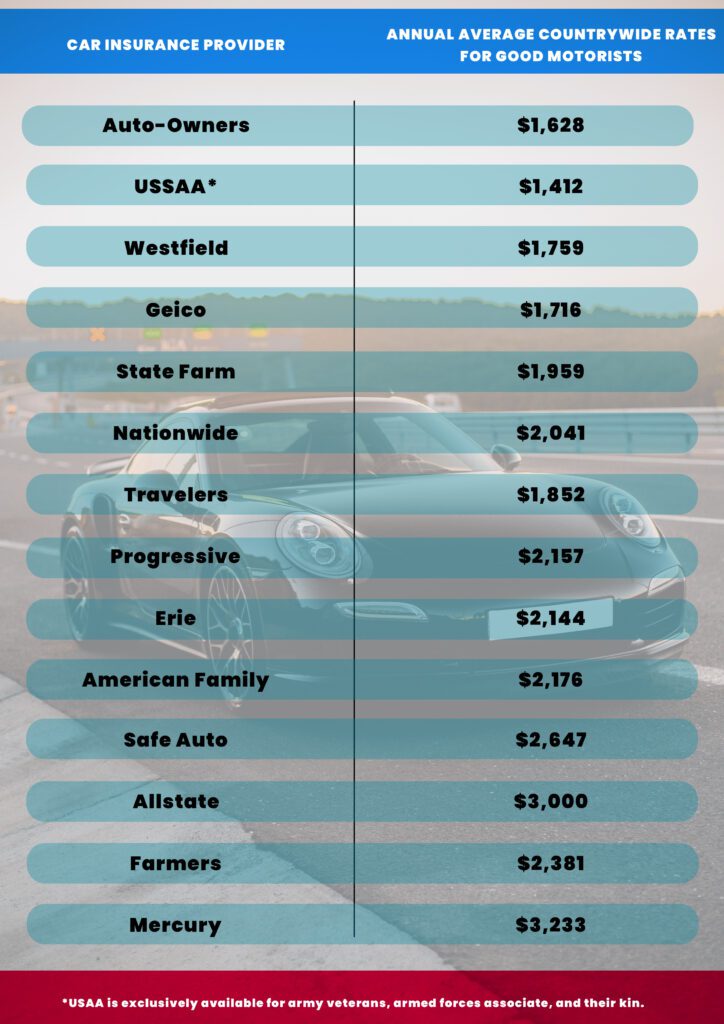

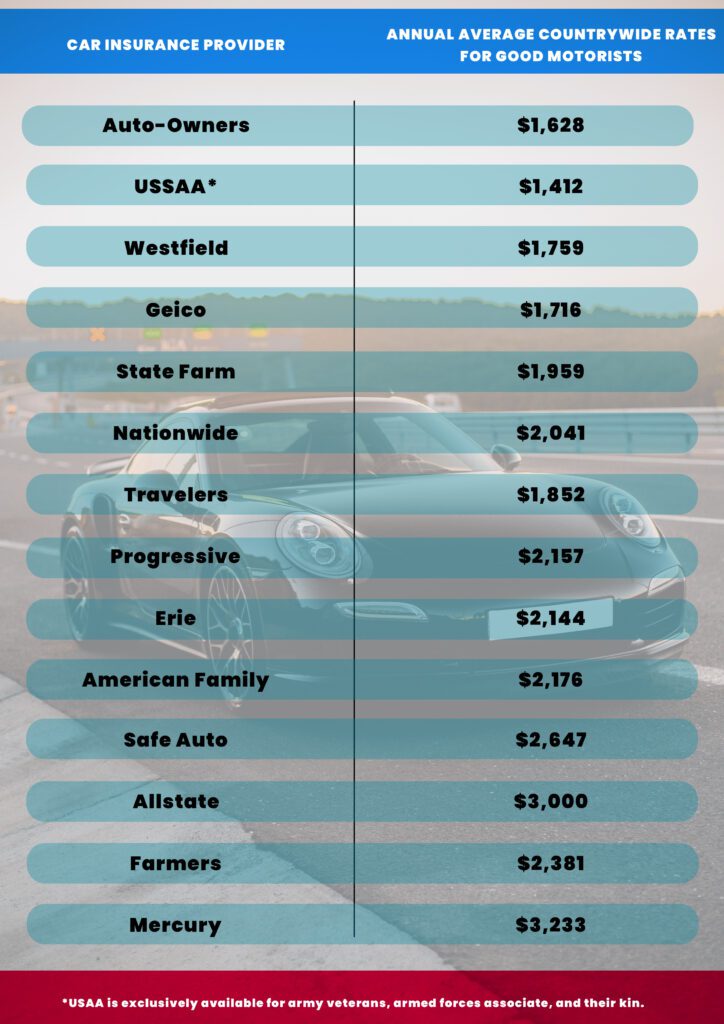

Cheapest insurance companies in specific states

Finding the cheapest insurance companies in specific US states requires careful research and consideration of various factors.

California

In California, Geico, Progressive, and State Farm often offer competitive rates for auto insurance policies.

Geico is known for its affordability and may provide low-cost options for drivers across the state.

Progressive’s flexible options and discounts can make it a cost-effective choice for many Californians. State Farm’s personalized approach and bundling discounts make it a contender for cheap insurance in California.

Texas

In Texas, drivers might find competitive rates with Geico, Progressive, and USAA for auto insurance coverage. Geico’s nationwide presence often translates to affordable premiums for Texas drivers.

Progressive’s customizable policies and discounts make it an attractive option for budget-conscious Texans.

USAA, if eligible, offers competitive rates and excellent customer service to military members and their families in Texas.

Florida

In Florida, riders often consider Geico, Progressive, and State Farm affordable auto insurance options.

Geico’s accessibility and competitive pricing make it a popular choice among Florida drivers seeking cheap insurance.

Progressive’s various discounts and policy options may provide cost-effective coverage tailored to Florida’s requirements.

State Farm’s local agents and discounts could make it a viable option for budget-conscious Floridians seeking coverage.

As of the latest update, identifying the absolute cheapest insurance companies in specific US states can vary based on multiple factors. These include driving history, age, location, and coverage needs. However, we have provided general guidance on finding affordable insurance in certain states.

General quotes from car insurance agents or other industry experts about car insurance

Car insurance agents and industry experts emphasize the importance of understanding coverage options and shopping around.

One expert advises that comparing quotes from multiple insurers helps find the best coverage at the lowest price.

An agent suggests reviewing policy details carefully to ensure they meet your needs and provide adequate protection.

According to industry insights, factors like driving record, vehicle type, and location significantly impact insurance premiums.

An agent notes that maintaining a clean driving record and bundling policies can help lower insurance costs.

Another expert highlights it’s essential to consider deductibles, liability limits, and optional coverages when choosing a policy.

Many agents stress that regularly reassessing your insurance needs and updating your policy can prevent gaps in coverage.

Industry advice includes not overlooking discounts for safe driving, multi-vehicle policies, or loyalty incentives offered by insurers.

An expert recommends seeking guidance from an experienced agent to help navigate complex insurance decisions.

Agents are often reminded that understanding state-specific insurance requirements is crucial to avoid penalties and ensure compliance.

Industry experts caution that we should be wary of excessively low premiums that may sacrifice essential coverage or compromise service quality.

An agent advises reading customer reviews and considering insurer ratings to gauge satisfaction and reliability.

Car insurance professionals emphasize informed decision-making and proactive management to secure optimal coverage.

Websites Links of Car Insurance Providers

- Auto-Owners

- USAA

- Westfield

- Geico

- State Farm

- Nationwide

- Travelers

- Progressive

- Erie

- Safe Auto

- Allstate

- Farmers

- Mercury

What factors in a state will push up the cost of car insurance, weather, crime rates, state regulations, etc.?

Several factors within a state can significantly influence the cost of car insurance. They range from weather patterns to regulatory environments and crime rates.

Crime rates

High crime rates in urban areas correlate with increased vehicle theft and vandalism. These frequently lead to higher insurance premiums.

Weather

Weather conditions such as frequent hailstorms, hurricanes, or snowstorms can elevate the risk of accidents and vehicle damage. Thereby, they impact insurance rates.

State regulations

State regulations play a pivotal role. Varying laws regarding minimum coverage requirements, no-fault insurance, and tort systems can directly affect insurance costs.

States with stringent regulatory requirements may experience higher premiums due to mandated coverage levels and regulatory compliance costs incurred by insurers.

Population

Additionally, densely populated states often witness more traffic congestion and a higher frequency of accidents, contributing to elevated insurance premiums.

Natural calamities

Areas prone to natural disasters like earthquakes or wildfires may also experience increased insurance costs due to higher risk profiles.

Healthcare services and amenities

The availability of healthcare services and the likelihood of expensive medical claims can influence insurance rates. This is particularly true in states with higher healthcare costs.

Socioeconomic factors

Moreover, socioeconomic factors like income and unemployment can indirectly impact insurance premiums. They affect the overall risk pool and claims frequency.

In summary, a combination of crime rates, weather patterns, state regulations, and socioeconomic factors collectively shape the cost of car insurance within a state.

FAQs on car insurance Peoria

1) What happens when a car accident claim exceeds insurance limits?

What happens when a car accident claim exceeds insurance limits? When a car accident claim exceeds insurance limits, the policyholder may become personally liable for the remaining costs. In such cases, the at-fault driver’s assets could be at risk. They may face lawsuits to cover the outstanding expenses beyond their insurance coverage.

2) My car caught on fire; will my insurance cover it?

My car caught on fire. Will my insurance cover it is a common question that car owners often ask the providers. Whether your car insurance will cover fire damage depends on your policy. Comprehensive coverage typically includes fire damage, covering repairs, or replacement if your car catches fire due to accidents, vandalism, or natural disasters. Check your policy details or contact your insurer for clarification.

3) Why is car insurance more expensive for teens and seniors?

Due to differing risk profiles, car insurance tends to be more expensive for teens and seniors. Teen drivers lack experience and are more prone to accidents. This prompts insurers to charge higher premiums to offset potential claims. On the other hand, seniors may face increased premiums due to age-related factors like diminished reaction times and health issues. These can increase accident risks.

Additionally, seniors may have more medical conditions affecting their driving abilities. These demographic groups often require more extensive coverage and are considered higher risks. These result in elevated insurance rates compared to other age demographics.

Wrapping Up:

In conclusion, navigating car insurance Peoria options requires diligence and understanding. With ample choices, finding the right coverage tailored to your needs is essential. Remember to regularly review your policy to ensure it meets your evolving needs and budget. You can make confident decisions about your coverage by staying informed about local driving conditions and potential risks. Don’t hesitate to explore discounts and bundle options to maximize savings without compromising protection. With the right policy, you can drive with peace of mind. You know you’re prepared for whatever the road may bring in Peoria. Drive safely and insured!

Leave a Reply