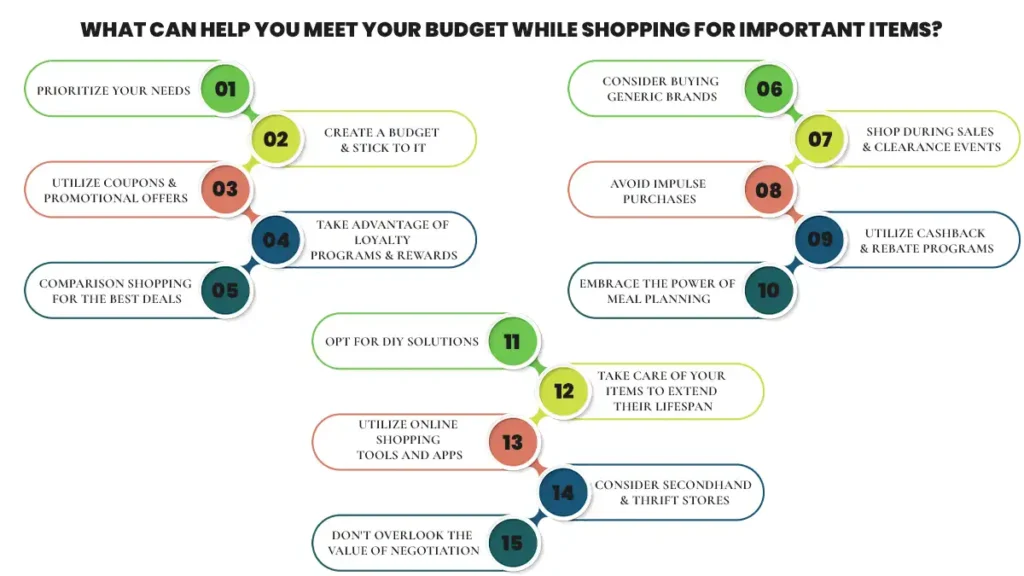

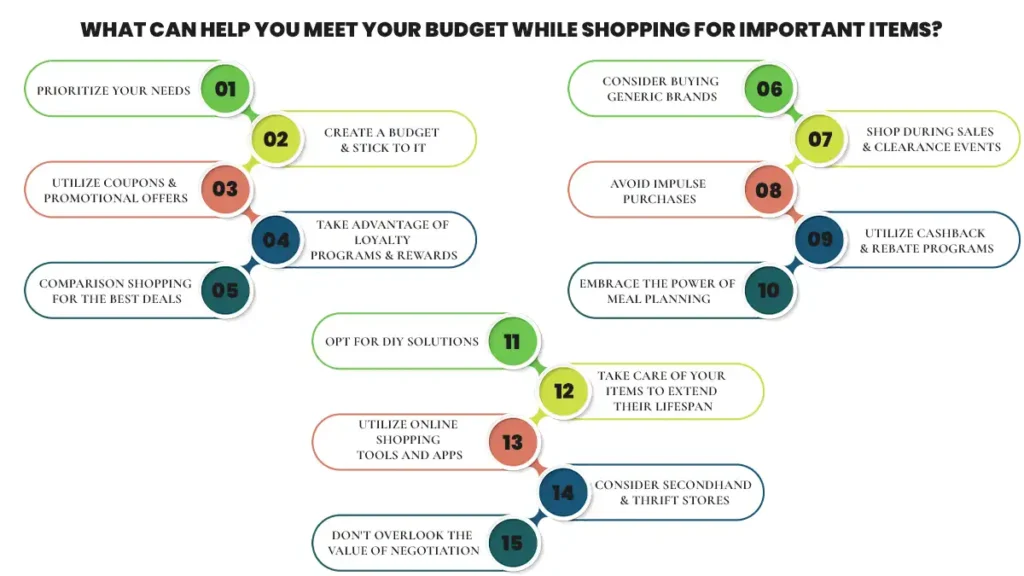

Shopping for important items can often be a financial challenge, especially on a budget. Whether it’s groceries, clothing, household essentials, or electronics, saving money without sacrificing quality is crucial. This guide will explore various strategies to help you meet your budget while shopping for essential items. These strategies include utilizing coupons and loyalty programs to compare shopping and prioritizing needs over wants. We’ll delve into practical tips that can significantly impact your overall expenses. Know what can help you meet your budget while shopping for important items.

What can help you meet your budget while shopping for important items?

1) Prioritize Your Needs

When mastering budget shopping, it’s crucial to prioritize your needs over wants. Evaluate necessities first. Identify essential items for daily living. Allocate funds accordingly. Focus on essential purchases such as groceries, utilities, and transportation. Limit discretionary spending. Differentiate between needs and desires. Opt for cost-effective alternatives. Utilize discounts and coupons for necessary items. Plan purchases to avoid impulse buying. Keep track of expenses to stay within budget constraints. Prioritizing needs ensures financial stability and efficient budget management. It’s a skill that can lead to long-term financial health and stability.

2) Create a Budget and Stick to It

Creating a budget is essential for financial stability. Start by listing all sources of income. Deduct fixed expenses first. Allocate a portion for savings and emergencies. Determine flexible spending categories. Track spending meticulously. Adjust as necessary to stay within limits. Prioritize needs over wants. Utilize budgeting tools or apps for assistance. Stay disciplined in adhering to the budget. Be mindful of impulse purchases. Regularly review and reassess your budget. Seek ways to cut unnecessary expenses. Focus on long-term financial goals. Sticking to a budget requires dedication and self-control but leads to financial freedom and security.

3) Utilize Coupons and Promotional Offers

When budgeting, leverage coupons and promotions to save money. Search for deals on essential items. Clip coupons from newspapers or online sources. Take advantage of loyalty programs and rewards. Utilize cashback apps for additional savings. Plan purchases around sales events. Compare prices before making purchases. Look for buy-one-get-one offers or discounts on bulk purchases. Combine coupons with store sales for maximum savings. Stay organized to avoid missing out on savings opportunities. Be mindful of expiration dates and terms of use. Use promotional codes when shopping online. Embrace frugality while enjoying quality products by utilizing coupons and promotional offers wisely.

4) Take Advantage of Loyalty Programs and Rewards

When budgeting, leverage loyalty programs and rewards to optimize your spending. Enrol in programs offered by stores. Accumulate points with every purchase. Redeem points for discounts or free items. Explore credit cards with rewards matching your needs. Earn cashback or travel perks on eligible spending. Utilize apps for tracking rewards efficiently. Strategically time purchases to maximize benefits. Watch out for special promotions or bonus point opportunities. Stay updated on program changes and offers. Adhere to program terms for maximum advantage. Loyalty programs can be invaluable in stretching your budget further while enjoying additional benefits.

5) Comparison Shopping for the Best Deals

Comparison shopping is key to finding the best deals and optimizing your budget. Start by researching prices online. Compare prices across different retailers or websites. Look for discounts, promotions, or special offers. Consider factors like shipping costs and return policies. Utilize price comparison tools or apps for convenience. Take note of product specifications and reviews. Don’t forget to factor in any additional expenses. Be patient and thorough in your search. Look for seasonal sales or clearance events. Don’t overlook smaller, local stores for potential savings. Comparison shopping ensures you get the most value for your money. It helps you stay within your budget while fulfilling your needs.

6) Consider Buying Generic Brands

Consider opting for generic brands to save money while maintaining quality. Compare ingredients and nutritional values. Generic products often offer similar quality at lower prices. Experiment with different generic options. Don’t let branding sway your decision unnecessarily. Reputable manufacturers produce many generic brands. Take advantage of cost savings without sacrificing quality. Check reviews and feedback from other consumers. Evaluate the value proposition of generic products. Be open-minded and willing to try new brands. Embrace the potential for significant savings over time. Generic brands can be a smart choice for budget-conscious shoppers. They provide excellent value without compromising on quality.

7) Shop during Sales and Clearance Events

Shopping during sales and clearance events is a savvy way to save money on purchases. Keep an eye on store promotions and advertisements. Plan your shopping trips around these events to maximize savings. Look for steep discounts on seasonal or discontinued items. Consider stocking up on essentials when prices are low. Take advantage of clearance sections for hidden gems. Be sure to compare prices and quality to ensure the best value. Stay flexible and open to different brands or styles. Avoid impulse purchases and stick to your shopping list. With careful planning, shopping during sales and clearance events can help you stretch your budget further.

8) Avoid Impulse Purchases

Avoiding impulse purchases is crucial for staying within your budget and making thoughtful spending decisions. Making a good purchasing decision requires pausing and reflecting before buying. Ask yourself if the item is truly necessary or if it fulfills a genuine need. Consider waiting 24 hours before purchasing to reduce impulse buying tendencies. Stick to your shopping list and prioritize planned purchases. Avoid shopping when stressed or emotional, as this can lead to impulsive decisions. Making a good purchasing decision requires setting a budget for discretionary spending and sticking to it. Consider the long-term consequences of impulse purchases on your financial goals. By exercising restraint and mindfulness, you can avoid unnecessary spending and stay on track with your budget.

9) Utilize Cashback and Rebate Programs

Make the most of cashback and rebate programs to maximize your savings while shopping. Research available programs thoroughly. Sign up for programs that align with your spending habits and preferences. Keep track of eligible purchases to ensure you receive cashback or rebates. Take advantage of promotional offers or bonuses to boost your earnings. Consider using cashback credit cards for additional rewards. Be mindful of program terms and conditions. These include minimum purchase requirements and expiration dates. Utilize online platforms that aggregate cashback offers for convenience. Maximize your benefits by combining cashback programs with sales and discounts. By leveraging cashback and rebate programs, you can effectively stretch your budget and get more value from your purchases.

10) Embrace the Power of Meal Planning

Embracing the power of meal planning can revolutionize your budget and health. Start by creating a weekly menu. Consider ingredients already in your pantry to minimize costs. Incorporate affordable, nutritious recipes into your plan. Batch cook meals to save time and money. Utilize leftovers creatively for subsequent meals. Make a shopping list based on your planned meals to avoid impulse buys. Shop strategically, taking advantage of sales and discounts. Consider buying in bulk for staple items. Experiment with vegetarian or plant-based meals for cost-effective options. By meal planning, you’ll save money, eat healthier, and reduce food waste.

11) Opt for DIY Solutions

Choosing do-it-yourself (DIY) solutions can be a thrifty and rewarding approach to various needs. Assess tasks you can tackle independently. Research tutorials or guides for guidance. Gather necessary materials or tools before starting. Consider repurposing items you already own to save money. DIY projects can range from home repairs to crafting and beyond. Explore DIY options for gifts, home decor, and personal care products. Take pride in the skills and creativity developed through DIY endeavors. Share your creations with others as thoughtful, handmade gifts. By opting for DIY solutions, you save money and foster self-sufficiency and creativity.

12) Take Care of Your Items to Extend Their Lifespan

Taking care of your belongings through budgeting can significantly prolong their lifespan and save money. Regular maintenance ensures durability. Regularly cleaning and proper storage prevent wear and tear. Investing in quality items pays off in the long run. Repairing when necessary avoids premature replacements. Utilizing warranties and guarantees can aid in maintenance costs. Learning basic repair skills reduces dependency on professionals. Keeping items organized prevents loss and damage. Prioritize repairs and replacements based on necessity and feasibility. Regularly assess the condition of your possessions. Implementing preventive measures can mitigate potential damage. Embracing a mindful approach to consumption promotes sustainability and resourcefulness.

13) Utilize Online Shopping Tools and Apps

Leverage online shopping tools and apps to optimize your budget and make informed purchasing decisions. Making a good purchasing decision requires comparing prices across multiple platforms for the best deals. Utilize price tracking features to monitor fluctuations and time your purchases strategically. Set up alerts for price drops and discounts to capitalize on savings opportunities. Take advantage of coupon and cashback apps to maximize your savings. Use budgeting apps to allocate funds for online shopping and track your expenses. Explore loyalty programs and rewards systems offered by online retailers. Research product reviews and ratings to ensure quality and suitability before purchasing. Streamline your shopping experience for efficiency and savings.

14) Consider Secondhand and Thrift Stores

When budgeting, explore secondhand and thrift stores to maximize savings and find unique items affordably. These stores offer a diverse range of pre-owned goods, from clothing to furniture. Opting for secondhand items reduces waste and promotes sustainability. Enjoy the thrill of hunting for hidden treasures and vintage finds. You can stretch your budget further and afford more with lower price tags. Supporting thrift stores also contributes to local communities and charities. Embrace the opportunity to express your style through eclectic and one-of-a-kind pieces. By shopping secondhand, you can often find high-quality items at a fraction of the cost. Take advantage of discounts and sales to maximize your savings even more. Overall, integrating secondhand shopping into your budgeting plan is a smart and eco-friendly choice.

15) Don’t Overlook the Value of Negotiation

In budgeting, recognize the significance of negotiation in securing better deals and saving money effectively. Whether purchasing goods or services, negotiation offers potential discounts and cost savings. Approach negotiations with confidence and preparation, armed with research and understanding of market prices. Be willing to walk away if terms don’t meet your budgeting goals. Seek out opportunities for negotiation in various transactions, from buying a car to renting an apartment. Polite and respectful communication can often lead to favorable outcomes. Remember that everything is negotiable, including pricing, fees, and terms. Embrace negotiation as a valuable skill that can significantly impact your financial well-being. Finding out what can help you meet your budget while shopping for important items is key.

What is one of the best ways to get reliable information about a product?

What is one of the best ways to get reliable information about a product? This is a relevant question often asked by consumers. One of the most reliable ways to gather information about a product is through thorough research across multiple reputable sources. Start by exploring the manufacturer’s official website, where you can find detailed specifications, features, and, often, customer reviews. These reviews, however, may be biased, so it’s essential to corroborate them with independent sources.

Next, delve into credible review websites and forums where users share their experiences and opinions. Look for platforms with a large user base and a history of providing honest and detailed feedback. Pay attention to both positive and negative reviews to get a balanced understanding of the product’s performance and reliability.

Another valuable resource is professional product testing and review organizations. Entities like Consumer Reports, Wirecutter, and PCMag conduct rigorous testing and analysis to provide unbiased insights into various products across different categories. Their in-depth evaluations can offer valuable insights into a product’s performance, durability, and value for money.

Also, consulting industry experts and influencers specializing in the relevant field should be considered. Experts often offer comprehensive reviews based on their expertise and experience. They provide valuable insights that may not be readily available elsewhere. However, be cautious of sponsored content and ensure the expert maintains objectivity in their recommendations.

Social media platforms can also be useful for gathering information about products. Join relevant groups or communities where members share their experiences and recommendations. Engage in discussions, ask questions, and seek advice from individuals who have firsthand experience with the product you’re interested in.

Furthermore, don’t overlook the importance of user manuals, product guides, and warranty information provided by the manufacturer. These documents often contain essential details about product specifications, usage guidelines, and maintenance instructions. These will help you make informed decisions and ensure proper product care.

Lastly, consider contacting the manufacturer or retailer directly with any specific questions or concerns you may have. Many companies offer customer support services via phone, email, or live chat. There, you can obtain personalized assistance and clarification on product-related inquiries.

In conclusion, you are hopefully familiar with the best ways to get reliable information about a product. Obtaining reliable information about a product requires a comprehensive approach that involves leveraging various sources. These sources include official websites, independent reviews, expert opinions, user feedback, and manufacturer resources. You can make informed decisions by thoroughly researching and cross-referencing information from multiple credible sources. You can also choose products that meet your needs and expectations.

Conclusion:

So, you have a fair idea about what can help you meet your budget while shopping for important items. Meeting your budget while shopping for important items requires a combination of smart strategies and mindful spending habits. By prioritizing your needs, creating a budget, utilizing coupons and promotional offers, and comparing shopping, you can stretch your dollars further without compromising quality. Additionally, exploring alternative shopping options such as generic brands, clearance events, and secondhand stores can provide significant savings. Remember to avoid impulse purchases. Take advantage of loyalty programs and cashback offers, and embrace DIY solutions whenever possible. With these tips in mind, you can confidently and easily navigate the world of budget shopping, ensuring that your financial resources are used wisely.

Leave a Reply