If you’re looking for a loan similar to payday loans eLoanWarehouse, you may be dealing with an unexpected expense and need emergency cash. According to a report from Pymnts and LendingClub, 59.8% of U.S. consumers live paycheck to paycheck. That means that numerous people are unable to afford a surprise bill.

Luckily, plenty of personal loans are available to help individuals access quick financial relief. But which loan option is best for you? Keep reading to learn how payday loans eLoanWarehouse work and how they compare to other bad credit loans.

Payday Loans EloanWarehouse: Finding the Right Personal Loan

The benefit of looking for a personal loan online is that you can conveniently compare your options before making a final decision. You can also apply with a lender from your computer or mobile phone.

However, finding the right personal loan for your financial situation takes time. It’s critical to ask questions, compare loan terms, and determine what type of personal loan you want.

Can I Use Payday Loans EloanWarehouse Personal Loans For House Repairs?

While many people use home equity loans for house repairs, payday loans eloanwarehouse may be more convenient. Although home equity loans may offer larger loan amounts, the approval process is complicated and can take several weeks. In addition, borrowers must use their homes as collateral, which is financially risky.

But payday loans eloanwarehouse personal loans can be obtained quickly, often within one business day. You could get the money you need sent via direct deposit to hire a plumber, electrician, or handyperson.

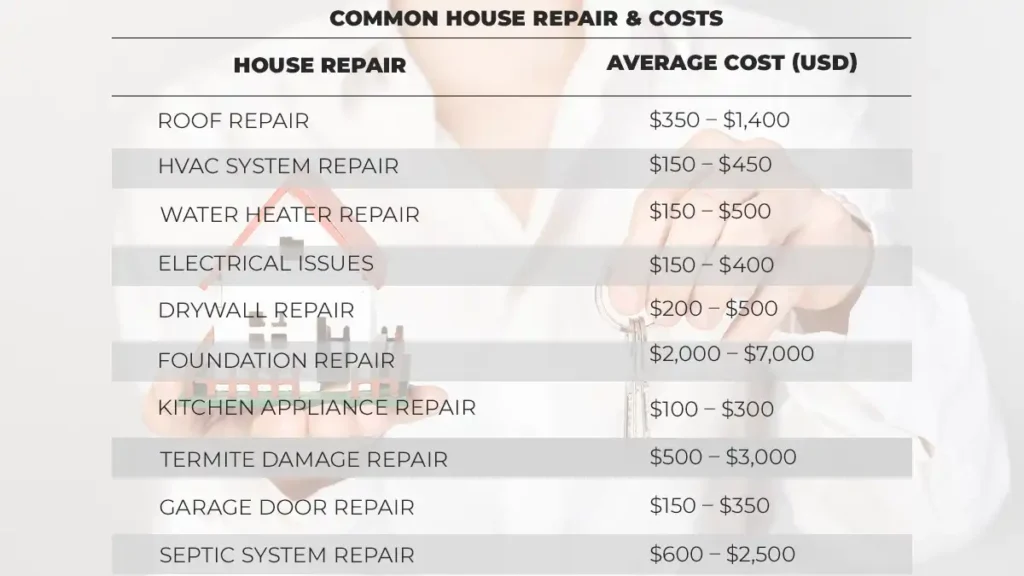

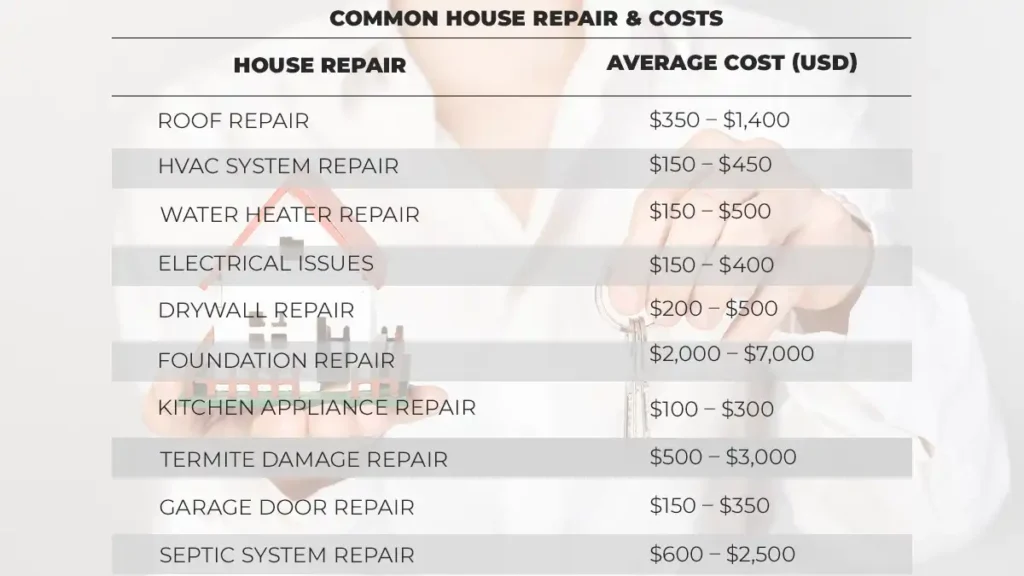

Take a look at the average cost of common house repairs to better understand how much money you may need:

Common house repair & costs

*Please note that these are just average estimates. For a precise quote, it’s always best to consult with a local professional who can assess your home’s specific needs.

How Do Personal Loans Compare To Payday Loans EloanWarehouse?

Installment and payday loans are common loan options for financial emergencies. But which option is better? Look at how online payday loans eloanwarehouse compare to personal loans below.

Eligibility

Most payday loans do not have a minimum credit score requirement. Instead, applicants may only need a steady source of income and an active checking account. Many people with bad credit assume they are ineligible for traditional installment loans. So they apply for instant payday loans. But it’s still possible to get a personal loan with bad credit.

When you submit a personal loan application, the lender will request your credit report from one of the three major credit bureaus. Your credit report is a file of your financial history. Many lenders with flexible requirements will look past your bad credit and consider other factors for approval.

Loan Amount

The loan amount for a payday loan is generally small. According to USA Today, the average payday loan is $430.2. You must take out multiple payday loans if you need more than a few hundred dollars to pay a medical bill or repair a car. In contrast, installment loans generally range from a few hundred to a couple thousand dollars.

Repayment Length

Payday loans eloanwarehouse are short-term loans that the borrower’s next payday must repay. This term is typically within 2 weeks. If the loan is not paid within that time, the payday loan extends for 2 weeks. The rollover adds additional interest and penalty fees to the outstanding balance, making repayment more difficult. Personal loans can have short to long repayment periods, allowing borrowers to pay off their loan balance through monthly payments.

Interest Rates

The interest rates for personal loans depend on the borrower’s credit score. However, rates can still be decent depending on the lender. However, rates for payday loans eloanwarehouse can be excessively high. The average APR for a payday loan is about 400%, which means a borrower will pay roughly $15 for every $100.2 Remember that interest rates determine the total loan cost. Very high rates can worsen a financial situation.

Fees

Online payday loans generally have a lot of fees, which can quickly increase the total loan amount of a small initial loan. An installment loan also comes with loan fees, such as origination fees. However, they typically cost less and don’t make the repayment process more difficult for the borrower.

Loans Similar to Payday Loans eLoanWarehouse: What You Need to Know

eLoan Warehouse, also known as Opichi Funds, is a tribal lender that provides installment loans online. the Lac Courte Oreilles Band of Lake Superior Chippewa Indians owns and controls this financial company. It is a federally recognized sovereign American Indian Tribe.

Interested borrowers need to submit an online loan application. The loan authorities will review the application according to payday loans eLoanWarehouse underwriting rules. If eligible, the applicant will receive a loan offer to sign. The lenders will then directly deposit the money into the applicant’s bank account within one hour.

What Loan Terms Can You Expect?

eLoanWarehouse provides installment loans that range from $300 to $2,500. However, new customers may only qualify for up to $1,000. 4 loyalty tiers allow repeat customers to access more money and longer repayment terms.

- New — Borrowers can receive a loan up to $1,000 for a 9-month term.

- Silver — Borrowers must make 7 cumulative payments to qualify for a loan up to $1,250 with a 9-month term.

- Gold—Borrowers must make 15 cumulative payments to qualify for a loan up to $1,500 with a 9-month term. They may also now qualify for a line of credit.

- Platinum — Borrowers must make 24 cumulative payments to qualify for a loan up to $2,500 with a 12-month term.

The average installment loan term is 6 to 12 months. eLoanWarehouse is marketed as an alternative to payday loans. However, it warns consumers that it has higher APRs than local banks and credit unions.

How Do Tribal Loans Work?

A sovereign government provides the Opichi Funds installment loan products. This means that tribal courts regulate Opichi Funds rather than state courts. If you do business with Opichi Funds, and you have issues with the lender, your options for resolution will be limited. The resolution will depend on Tribal law and your loan agreement.

Unlike traditional lenders, Opichi Funds are not subject to suit or service of process. As stated on their website, you should seek an alternative loan option if you are uncomfortable doing business with a sovereign instrumentality that you cannot sue in court.

Payday loans eLoanWarehouse: What Are the Requirements?

An applicant must meet certain requirements to be eligible with eLoanWarehouse. If you’re interested in getting an installment loan, you must have the following:

- A verifiable source of direct deposit income into your checking account.

- An open checking account that meets “bank account minimum opened duration” requirements.

- You must be at least 18 years old and a United States resident.

- Your take-home pay has to meet minimum income requirements.

- You must not currently be a debtor in a bankruptcy case or intend to voluntarily file for bankruptcy relief.

- You or a member of your family must not be a member of the Military.

CreditNinja: How Does It Compare?

CreditNinja is an online lender that provides installment loans. Since 2018, CreditNinja has originated over 475,000 loans to help nearly 275,000 people!

CreditNinja aims to provide affordable fast cash loans for borrowers with bad credit scores. It works at ninja speed to help you get the money you need to pay unexpected car repairs, medical bills, and much more!

Credit Ninja’s Installment Loans

CreditNinja personal loans are an alternative to payday loans and cash advance loans. While these loans are fast and easy to get for bad credit borrowers, they are very pricey. Many financial experts advise consumers against using payday and cash advance loans due to predatory interest rates and unfair loan terms.

CreditNinja installment loan terms are designed to be flexible and personalized for each borrower. They understand that one single loan offer will not work for every customer. That’s why when an applicant gets approved for an installment loan, they will receive a loan amount, rate, and repayment length for their unique financial background.

How Does CreditNinja Stand Out?

CreditNinja provides more than just fast emergency cash. They aim to provide benefits that help borrowers manage their loans and improve their repayment experience.

These are just a few of the perks they offer their customers:

- Easy Application Process—The application process is entirely online, allowing interested applicants to apply at any time on their phone or computer.

- Flexible Credit Requirements—Similar to cash advance loans, CreditNinja personal loans offer flexible approval requirements. It’s possible for someone with bad or no credit to qualify for one because they consider more than just credit when making approval decisions.

- Fast Cash—Eligible borrowers can receive money sent directly to their bank account as soon as the same day! You don’t have to stress about quickly getting money to improve your situation.

- Flexible Repayment Lengths—CreditNinja offers short and extended repayment plans to accommodate all kinds of financial budgets. And if you ever want to pay off your loan early, you can! CreditNinja does not charge prepayment penalties.

- Quality Customer Service offers exceptional customer service that rivals other online lenders. Read some online reviews to better understand what you can expect from working with CreditNinja.

How Will the Loan Process Work?

The CreditNinja application process is incredibly quick and easy. If you’re interested in working with them, you must submit basic information via their website or mobile app.

After receiving your application, they will consider your financial needs and background. If you are eligible for an installment loan, you can e-sign your loan agreement and complete the simple bank verification process. They will send your money straight to your checking account. Therefore, you can start taking back control of your life as soon as possible!

FAQs about Loans Similar To payday loans eLoanWarehouse

What are the main differences between payday loans and installment loans?

While both can provide quick cash, payday loans are typically due on your next payday and can have higher fees. Borrowers must pay back installment loans, like those from eLoanWarehouse, over a set period, usually with fixed monthly payments.

Can I qualify for online payday loans with bad credit?

Absolutely! Many payday advance providers offer loans to individuals with less-than-perfect credit. Your credit history might not be the sole factor in the approval decision for payday loans. But remember that there are payday loan alternatives, such as personal installment loans. These also have flexible credit requirements.

How do payday loans and installment loans affect my credit history?

Making timely installment or payday payments can positively impact your credit history. Conversely, late or missed payments can harm your credit score. Always manage payday loans and installment loans responsibly. Autopay and monthly payment reminders can help avoid late or missed payments.

Are there payday loan alternatives for quick cash advances?

Yes, there are payday loan alternatives if you need a quick cash advance and have low credit scores. Alternative options include installment loans, credit union loans, or borrowing from friends or family. Each option has pros and cons, so consider what’s best for your situation.

What should I consider before applying for online payday loans?

Before applying for online payday loans, consider the fees, interest rates, and repayment terms. Ensure you understand the total cost and whether you can repay the loan on time. Many financial calculators are available online that can help you determine how much you will end up paying to borrow money.

How quickly can I receive funds from a personal loan?

Many lenders offer quick processing; you might receive funds as soon as the next business day. However, the timing can vary based on the lender and your bank’s processing times.

What are the typical interest rates for bad credit loans?

Interest rates for bad credit loans can vary widely based on the lender and your specific financial situation. Generally, they might be higher than loans offered to individuals with good credit, reflecting the higher risk to the lender.

How can I ensure I’m choosing the right payday loan alternative?

To choose the right alternative, compare different options’ total costs, repayment terms, and additional fees. Also, consider how quickly you need cash advance funds and whether the repayment schedule fits your budget.

Conclusion: The Bottom Line

Various online lenders offer installment loans. But the right option depends on your financial needs and preferred repayment terms. There is no universal loan option that will benefit every borrower. But looking for an installment loan similar to online payday loans eLoanWarehouse allows you to quickly and easily find the right choice.

CreditNinja is here to help you make better financial decisions and understand your loan options. Check out their free blog for information on ordering online without a credit card, how to quickly reduce credit card debt, and much more!

Applications approved before 10:30 a.m. CT Monday-Friday generally get the funds the same business day. Applications approved after this time usually get the funds the next business day. Some applications may require additional verification. In these cases, loan funding, if approved, will take place the business day after such additional verification is over.

Leave a Reply